In March 2020, unregulated crypto exchanges, led by Binance, switched to USDT as collateral for margin trading. This has led to a progressive release of around 1 million Bitcoins previously locked as collateral. The fact these newly available Bitcoins didn’t crash the price only makes sense if Tether scooped them up and is now holding them as reserves.

Continue reading “The Great Tether / Bitcoin Collateral Flippening”The “Bitcoin Economy” is Just an Illegal Casino Run by the Mob

Since crypto’s near-death experience of March 2020, three things have risen in tandem: the price of Bitcoin, the market cap of Tether, and the number of people under lockdown at home, turning to day-trading as a way to kill time. These three trends are closely intertwined.

Continue reading “The “Bitcoin Economy” is Just an Illegal Casino Run by the Mob”How regulation empowers crypto exchanges to facilitate money laundering

Crypto exchanges are regulated entities. This is shown as proof of trustworthiness by the crypto industry. However, the regulations to which crypto exchanges have to comply are completely outdated and inadequate.

In the United States, crypto exchanges have to register with the FinCEN as “money transmitters”. It’s a category within the Money Services Business (MSB) classification, which encompasses activities such as broker dealer, forex operators, or cashiers. The crucial part is that MSBs in general and money transmitters in particular are subjected to much less stringent AML/KYC regulations than banks. In the case of crypto, this is ludicrous.

Continue reading “How regulation empowers crypto exchanges to facilitate money laundering”Want to buy Bitcoin at $66,700? Here’s how.

MicroStrategy Incorporated (stock ticker: $MSTR), the company widely acclaimed in the cryptosphere for buying 70 470 Bitcoins as a “treasury reserve asset”, whatever that means, closed yesterday at $631. That’s a roughly $450 return for anyone who has bought the stock before their Bitcoin gamble.

Continue reading “Want to buy Bitcoin at $66,700? Here’s how.”Bitcoin Investing Dictionary

With Bitcoin crashing and burning and margin traders getting liquidated, it’s important to relax, and have a good laugh. You’ll get over it, like millions of degenerate gamblers got over it in centuries prior (minus those who jumped out the window), and like billions of degenerate gamblers will get over it in the future.

With time, you’ll learn from your mistakes, pay back all your gambling trading debts, find an honest job, a compassionate wife, and be happy. But now, to help you cope, allow me to try and cheer you up. You might already have watched my Hitler Discovers He Can’t Cash Out video (which top ticked the market perfectly, proving that I’m a genius). Please treat yourself with the following investing dictionary, written with the tears and blood of previous wannabe investors.

Tether: Unchained Credit on the Blockchain

Peter McCormack’s podcast with Paolo Ardoino and Stuart Hoegner from Tether/Bitfinex did shed some light on Tether’s operations. Stuart Hoegner, the general counsel, answered most of the questions. Given his position, the devil wasn’t in what he said, but how he said it.

Overall, it was a performance of deflecting questions, making legally true statements, and trying to sound legit AF while accusing “nocoiners” of creating “FUD”. Tether really needed to rebuild some goodwill with the coiner community.

Continue reading “Tether: Unchained Credit on the Blockchain”Hitler’s Shitcoin Gets Sued By The SEC

Any resemblance to actual individuals or events is absolutely intentional.

Hitler Discovers He Can’t Cash Out

Hitler has been accumulating Bitcoins for months, but something went terribly wrong. A short story of FOMO, Tether, and Ponzi mechanics.

Tether: Heads I Win, Tails You Lose

Tether is the entity that issues and manages the USDT stablecoin. The “entity” wording is key: although Tether is incorporated as a Hong Kong company, its offices don’t seem to exist at the filing address, its CEO and CFO are M.I.A., and the bulk of communication is performed by its CTO, Paolo Ardoino.

USDTs are crucially important to the crypto ecosystem. Pegged 1:1 to the US dollar, they enable instantaneous transfers of huge sums of money between industry players, without having to explain to a bank what you’re doing. USDTs are, for all practical purposes, almost like money.

Until they aren’t.

Continue reading “Tether: Heads I Win, Tails You Lose”The Tether Press and Bitcoin’s Speculative Mania

Tether has become a plain old fiat central bank, issuing new USDTs against debt. USDTs are backed, but not by US dollars. They are backed by promises to make good on their debts by the receivers of newly minted USDTs.

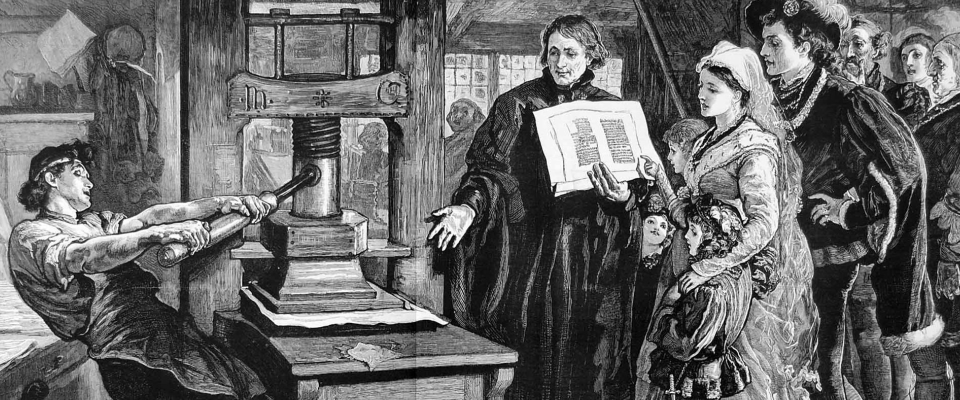

While it’s not fraudulent per se, the fact that USDTs aren’t backed by US dollars opens the door to unlimited USDT printing. The gatekeepers are the people in charge of the Tether printing press. In an ideal world, they should ensure that proper reserve requirements are met and that the receivers of newly minted USDTs are properly capitalised.

However, Bitcoin’s exponential price rise, happening in lockstep with ever-increasing USDT issuance, shows that the Tether press has gone in overdrive. When the mania will end, crypto investors will lose everything, in a second.

Continue reading “The Tether Press and Bitcoin’s Speculative Mania”